Art Basel and UBS Global Art Market Report 2021

More from Dr Clare McAndrew and Adrian Zuercher

By Vivyan Yeo

Gesyada Siregar. Photo by Nasha Razak.

The fifth edition of the Art Basel and UBS Global Art Market Report reveals key trends in the global art market in 2020 and analyses how the Covid-19 pandemic has impacted trade. Dr Clare McAndrew, Author of the Global Art Market Report and Adrian Zuercher, Head Global Asset Allocation at UBS Global Wealth Management CIO share their thoughts with A&M on what the report findings mean for Asia.

Dr Clare McAndrew. Photo by Paul McCarthy.

Adrian Zuercher. Image courtesy of UBS.

Key findings include:

Wealth in Asia, particularly among female entrepreneurs, rose despite the pandemic.

Collectors in Asia have a high representation of works by living artists in their collections.

Asia showed a slightly lower use of online platforms overall in 2020.

Innovation will be key to attract millennial collectors, who have been the most active across both offline and online channels.

Millennial collectors value price transparency in online offerings.

Clarity and guidance from auction houses and galleries are important for new collectors.

The Art Basel and UBS Global Art Market Report 2021, p. 302.

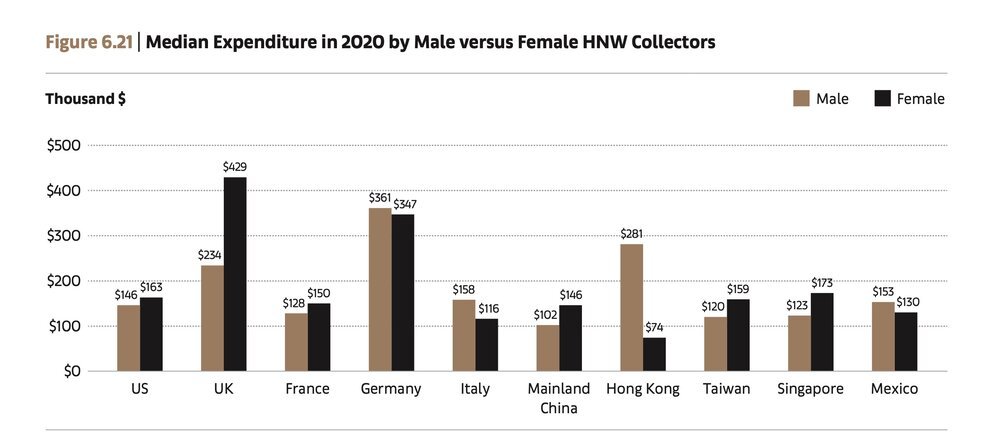

Wealth in Asia, particularly among female entrepreneurs, rose despite the pandemic. According to Zuercher, the number of female entrepreneurs and billionaires in Asia increased faster than their male counterparts in 2020. He says, “This correlates with one of the key findings from our survey on high net worth (HNW) collectors in 2020, which showed that female collectors in Mainland China, Singapore and Taiwan are spending more on art than men.”

The Art Basel and UBS Global Art Market Report 2021, p. 295.

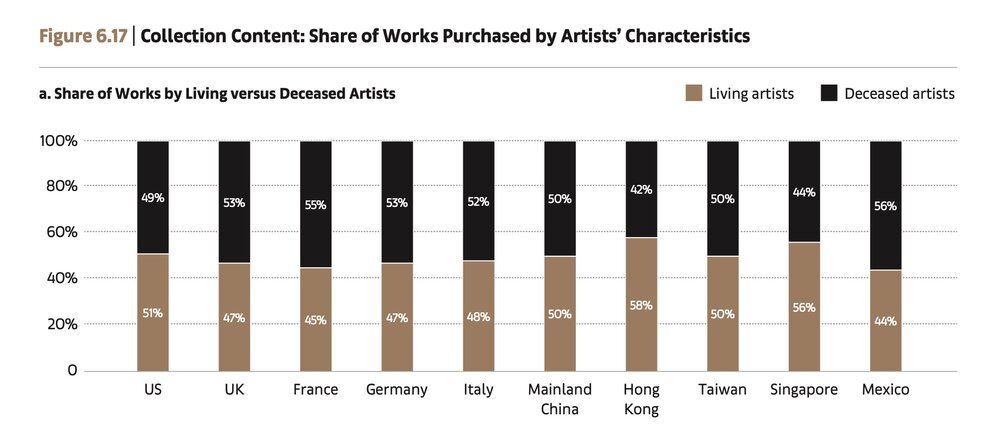

Collectors in Asia have a high representation of works by living artists in their collections. “What I find encouraging is that the collections in Hong Kong and Singapore indicate support for the primary market,” reflects Zuercher. This view is echoed by Dr McAndrew, who notes that there is a slight margin of collectors in Asia who purchased from galleries over auctions. “This could be due to a greater interest in primary market works in these regions,” she explains. “Although the work of many well-known living artists are sold at auction, most living artists’ works are sold on the primary market.”

The Art Basel and UBS Global Art Market Report 2021, p. 243.

Asia showed a slightly lower use of online platforms overall in 2020. “This can be attributed to a number of factors including greater preferences for offline, more opportunities to buy offline (as there were more live events and exhibitions in Asia in the second half of the year),” Dr McAndrew elaborates. “And the use of alternative platforms such as WeChat, which were not included in this report.” This slightly lower use of online platforms among collectors in Asia, however, does not necessarily correlate to less sales. Zuercher adds, “Some collectors in Taiwan reported that they had spent over US$50 million online during their years of collecting, the highest sum compared to collectors in all other markets.”

The Art Basel and UBS Global Art Market Report 2021, p. 297.

Innovation is key to attracting millennial collectors, who are the most active across both offline and online channels. “In the absence of art fairs, it has become difficult to reach new buyers and be distinct amongst the large volume of competitive offerings online,” explains Dr McAndrew. “Overall, collectors reported that they were easily overwhelmed with online offerings, and the businesses that stood out were those who had opted for more individual approaches, including offline outreach. Millennial collectors were some of the most keen to travel again and get back into events, so finding ways to combine the excitement of offline events alongside the efficiency and accessibility of online programs will be key in building their interests.”

Millennial collectors valued price transparency in online offerings. “Gallery policies still vary with regards to the posting of prices online, but the shift towards greater price transparency in 2020 through OVRs and other platforms was seen by many collectors as very positive,” says Dr McAndrew. “In Singapore and Hong Kong, for example, 78% of collectors felt it was important or essential to have a price posted while they were browsing artworks online, while 18% of collectors were happy to contact the gallery for a price. None of the collectors in Hong Kong and only 2% in Singapore preferred not to have the price posted.”

In line with the need for price transparency, clarity and guidance from auction houses and galleries are important for new collectors. Although the most commonly-used channel for purchasing art online in 2020 was through online auctions, which has transparent fee structures, the practicalities of bidding online are complex. Dr McAndrew shares, “A few auction houses relayed that when there are many new bidders who are not used to the conventional auction process, there might be a rise in procedural and legal misunderstandings; this may lead to defaulting buyers, who bid in excitement without understanding the fee structures that come on top of the hammer price.” She advises, “clarity and clear guidance can help new collectors, young or old. Providing a positive, easy and fulfilling experience to first-time buyers is critical in having them become long-term collectors.”

To download the full Art Basel and UBS Global Art Market Report 2021, click here.